Calculating...

Advanced Salary Calculator Pro

Professional salary analysis with CTC breakdown & reverse calculation

Salary Distribution

Monthly Comparison

What Is an Advanced Salary Calculator?

Using a state-of-the-art salary calculator, employees, recruiters, and payroll professionals can swiftly and precisely determine their take-home pay. This efficient tool instantly generates results, eliminating the manual hassles of computing deductions, allowances, taxes, and net income.

Job seekers and payroll experts alike can seamlessly figure out their net earnings by simply keying in their basic salary into this robust online calculator. The tool instantly computes the necessary figures, relieving you from the tedious task of manually calculating deductions, allowances, taxes, and net pay.

In many countries, including Pakistan, India, the United Kingdom, and the United States, a gross salary alone does not accurately represent the net income received, as various deductions—such as taxes, social security contributions, provident fund (PF), retirement contributions, and insurance—diminish the final amount.

This calculator helps you transform: the starting salary is converted into a net (take-home) pay rate. Applying precise formulas and sound logic.

Why Use an Advanced Salary Calculator?

- Conserves precious time

- Ensures accuracy

- Helps to plan finances

- Useful for income negotiations

- Facilitates scrutiny of job offers

- Excellent for consultants and independent contractors.

Whether you are:

A paid worker,

Entrepreneur and freelancer,

Someone evaluating a job offer,

Or a payroll professional,

This scale provides an accurate picture of your actual earnings.

Key Income Terms and Definitions

To use the calculator correctly, you must understand the basic terms and factors that influence your salary:

Basic Pay

This is the most important component of your compensation package—usually a fixed sum paid before allowances and deductions.

For Example:

The start-up wage is ₹30,000 / PKR 50,000 / $2,000

Important Notes:

It is the foundation for numerous benefits.

Taxes and deductions are frequently computed with it.

Allowances are applied on top.

Allowances

Allowances are supplemental compensation above the base salary and typically include:

House Rent Allowance (HRA)

Travel Allowance

Medical Allowance

Entertainment Allowance

Depending on national tax regulations, these could be fully or partially taxable.

Gross Salary

The net wage equals basic salary plus allowances.

This figure shows total earnings before deductions.

For Example:

Initial earnings: 50,000

Allowances: 10,000

Gross compensation is equal to 60,000

Deduction

Deductions are amounts subtracted from gross salary and may include:

Income Tax

Social Security

Provident Fund / Pension

Professional Tax

These vary according to country and employee status.

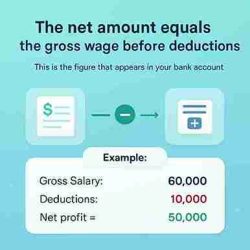

Initial salary and dividends

The net amount equals the gross wage before deductions.

This is the figure that appears in your bank account.

Example:

Gross Salary: 60,000

Deductions: 10,000

Net profit = 50,000

Earnings Calculation Equations and Formulas

Salary appraisals involve formulas based on government rules and finance standards.

Here are the key equations that most advanced salary calculators use:

1. The Gross Wage Formula

The total salary equals the basic salary plus allowances.

The total compensation equals basic salary plus allowances.

2. Provident Fund Calculation

Most employers and employees contribute a portion of their basic salary to a retirement fund.

Workers’ PF equals basic salary multiplied by the PF percentage.

Employer PF is equal to the basic salary multiplied by the PF percentage.

3. Calculate your taxable income.

Taxable income equals gross salary minus any tax exemptions.

Each country defines tax slabs differently.

4. Revenue Tax Calculation.

Depending on your tax bracket:

Revenue tax equals taxable income multiplied by the tax rate.

This could be progressive, with different slabs moving at different rates.

5. Gross income (money taken home).

Average Salary = Gross Salary – (Tax + PF + Insurance + Other Deductions)

This is the final amount you will receive.

How To Use the Advanced Salary Calculator

Step 1

Enter Your Basic Salary

Enter the exact basic salary that you earn or expect to earn.

For example:

Basic annual earnings: PKR 50,000.

OR US $2,000

OR, INR 30,000

Step 2

Provide allowances.

If your package has allowances like

HRA

Travel Allowance

Medical Allowance

Enter these amounts. Most calculators provide optional fields for these.

Step 3

Select Deductions

Select the correct deductions:

Income tax

Provident Fund

Pension contributions

Insurance

Every deduction lowers the final take-home pay.

Step 4

Click 'Calculate.'

After completing all required fields:

Hit the Calculate button.

And instantly, the tool displays:

✔ Gross salary

✔ Total deductions

✔ Take-home salary

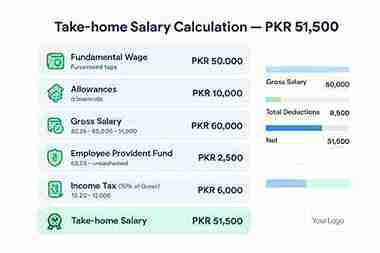

Real-World Example

Let’s walk through an example manually:

Input:

The fundamental wage is PKR 50,000

Allowances: PKR 10,000

Employee Provident Fund: 5%

Income Tax Rate: 10%

Calculation:

Gross salary equals $50,000 plus $10,000, or $60,000.

The PF deduction is calculated by multiplying 50,000 by 5%, which equals 2,500.

Income tax: 60,000 multiplied by 10% equals 6,000.

The total cutoffs are 2,500 + 6,000 = 8,500.

Take-Home Salary: 60,000 minus 8,500 = 51,500

Result:

Take-Home Salary is PKR 51,500

The Importance of Accurate Salary Calculations

An advanced salary calculator can serve you

1. Financial Planning

Determine how much money you’ll have per month to spend on food, rent, bills, savings, and living expenses.

2. Job Negotiations

When comparing offers, use net salaries rather than gross salaries.

Example:

Company A offers $3,000 gross, but with heavy tax and deductions

Company B offers $2,800 gross, but with minimal deductions

Result: Company B may pay better take-home pay.

3. Comparing Pay Across Cities/Countries

Tax rules vary widely, so this tool helps compare jobs in different regions.

4. Retirement and Savings Planning

Understanding your take-home salary allows you to determine how much you can save for long-term goals.

Common Earnings Components Explained

🧾 First Salary vs Gross Salary

The initial salary is only part of the total package.

The perks are included in your gross salary.

🏠 Allowances

Bonuses increase take-home pay without increasing taxable income significantly (in some tax systems).

Examples:

Housing Allowance

Medical Allowance

Transportation allowance

📉 Deductions

These can vary by country. The major deductions include:

Government taxes

Social insurance

Retirement contributions

Stay up to date on your local tax laws.

Salary Calculation Tips for Employees

✔ Never hesitate to inquire about net earnings, not gross.

✔ Know your tax bracket.

✔ Don’t forget employer contributions.

✔ Compare job offers based on net income.

Freelancer and Consultant Salary Calculation

Many freelancers do not have their taxes deducted at the source. This calculator can help you estimate:

What is the amount of taxes you must pay?

After deductions, the net amount that you keep

Set up a budget for quarterly tax payments.

Salary regulations vary by country.

Salary calculation varies by country. Here is a snapshot:

Pakistan

Income tax is calculated in progressive slabs.

Provident Fund (where applicable)

Social Security Contributions

India

Income Tax Plans Based on Age and Income Band

Professional taxation (in some states)

The Statutory PF

USA

State income tax (in certain states)

Social security

The Medicare system

The Premium salary calculator offers accurate tax presets for the USA, UK, Canada, UAE, Pakistan, India, Germany, and France, as well as a fully customizable manual tax mode.

It is also available as an Advanced Income Tax Calculator for AY 2025-26 in South Asian countries such as Pakistan and India. HMRC (UK) and the Canada Revenue Agency (CRA) are two data sources.

Note: Always check the most recent tax laws, which are updated annually.

Common Salary Calculation Errors

- Tax avoidance.

- Ignore the retirement and insurance contributions.

- The distinction between gross and net salaries can be ambiguous.

- Budgeting without a take-home estimate.

Frequently Asked Questions

What does “take-home pay” mean?

The wage you receive at home is your net pay after all deductions from your gross salary, including taxes, insurance, and provident fund.

Is it possible to calculate deductions and allowances with this calculator?

Yes. This advanced salary calculator allows you to enter allowances and common deductions such as taxes and retirement contributions.

How often do tax rules change?

Most countries update their tax slabs on an annual basis, so always use the most recent rules to ensure accurate outcomes.

Is the calculated net salary accurate?

Yes, as long as the correct information (allowances, tax percentage, and deductions) is provided.

Does basic salary include benefits?

Although the basic salary is the most important fixed component, benefits and allowances are typically added to the gross salary.

Real-Life Applications Of Salary Calculator

Job Seekers

Before accepting any offers, compare your final take-home salary.

Employees

Know what you’ll get at the end of the month.

HR/Payroll

Quickly estimate salaries during budgeting season.

Independent contractors

Understand tax implications and plan quarterly tax payments.

Financial Planners

Try out the calculator to suggest better budgeting & spending plans.

This tool saves you time.

Rather than manually:

✔ Checking tax laws.

✔ Determine expenses

✔ Perform complex math.

This tool provides results in less than a second, saving time and reducing errors.

Discover more smart tools from NexezTool.

Optimize your productivity with our most popular tools:

View grades, metrics, and academic performance instantly.

Generate accurate merit scores for admissions and exams.

Trading Position Size Calculator

Risk Management Tool For Forex, Crypto & Stocks